2 posts were split to a new topic: Taxpayer filed 2018 & 2019 as a non-resident alien but is currently resident alien

Hello,

Please refer latest update on stimulus cheques for H1b and H4. It is not mandatory to have SSN to get stimulus checks. ITIN holders also get cheque…

Can we update blog for benefit of H1b families filing Married jointly

Hi @laknk

The bill link you have shared tells that this bill has been ‘introduced’. It is not applicable until it passes both house and senate and signed by president.

The chances of this bill passing are extremely low.

Thanks Anil for clarifying. This helps and hope for the best

I have received stimulus check in 2008 when I was on L1B. To be frank, i still don’t understand why stimulus check is given to people who have jobs. I wish they only give more benefits who have lost the job.

Hi @Anil_Yadav

At the government and IRS level, it is really difficult to filter out people with jobs. The easiest, fast and cost effective way is to give amount based on your tax return.

That’s why they have the diminishing amount once your family income is above a certain level.

If I filed my girlfriend taxes two days ago on April 12th and she qualifies under the 70 k a yea. Will she receive her stimulus check with her federal tax return???

Yes, i think she will receive it. The check payment will be available till Dec 2020. So, no need to worry.

You will be paid if you are eligible.

Hi Anil,

My Spouse H4 EAD is approved in March-2020 and she received her SSN on 7th April, 2020. I have filed my 2019 Tax return 2 days back with Spouse SSN as Married Joint filing. Do we get Stimulas Check in this case?

Hi @girish.sjce

If you read my reply above, you would have got the answer. Please save both my and your time.

Yes Anil, I saw your post after posting my query, it was similar only and cleared my doubt

Thanks

-

The US as a whole considers us as Non-Immigrants. USCIS considers us the same

-

It’s IRS which qualifies us as “Resident Aliens” just for tax purposes

-

We got the payments because are considered resident aliens according to IRS

-

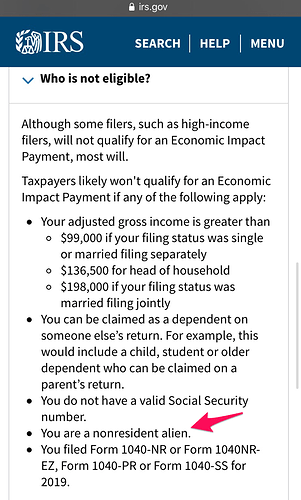

F1/OPT/CPT people are not getting this … they are ineligible Because IRS considers those statuses as Non-Resident

-

It’s probably fair to say In order to make more money from taxes they put H1b under resident status for tax purposes

. -

Otherwise every non-immigrant is a non-resident till they get GC

Conclusion - it’s a confusing scenario … should we better be safe than sorry?

What do you think?

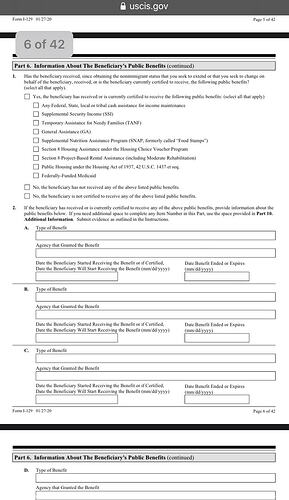

The screenshot above is the H1b application, in form I-129 there is a specific question now. Unsure which category this stimulus payment falls under

sorry to over whelm with too many posts just trying to understand the consequences

For Tax purpose, you have to use the IRS substantial presence test to know if you are ‘resident alien’ or not.

This status is not same as your visa status.

Hello, I got my H1b Nov 2018. Am I consider resident alien for 2019 ?