Originally published at: IRS Substantial Presence Test Calculator (All Visa Types) - AM22Tech

IRS substantial presence calculator helps you find the US tax residency based on your stay in the US. A foreign national is taxed in the US as a resident or a non-resident alien based on the number of days you have spent physically in the US. What is a Substantial Presence Test? The US tax…

Hi Expert,

I lived in USA since 2012 to 2019 on Canadian TN work Visa with family. During August 2019, my TN visa was withdrawn. I came back to USA on F1 student visa during Dec 2019 with my spouse and children. I lived in USA through out the year 2020. I also withdraw funds from 401k for paying tuition fee for myself, spouse on F1 status and university attending children. My wife is on F1 status too, received a small grant as scholarship from the college for her tuition fee.

Could you please advise my residency status for tax filing for the year 2020 and what type filing is appropriate in my status.

Do I pass the SPT? Should I file 1040 or 1040NR?

Did you use the app? What does it show as your residency status?

Hi Anil, thank you for the reply.

The app said Non resident alien. When I spoke with SprintTax, partner of Turbotax, said I am resident alien based on past 8 years resident alien status. Bit of confusing.

Syed

You must have entered wrong values in the app is what i guess.

Looks like there may be a bug in the app for F1 visa. I hope they fix it soon.

Not sure. What do you think of my residency? Are you a CPA?

I think you will be considered resident alien for tax purpose.

How did you come to that thought?

while I test the Substantial Presence Test, it says, I should have been in USA during 2020 for minimum of 31 days to be Resident alien. F1 student is exempt to count those days. I am confused

I tested your situation using the app and it seems you are not resident alien based on IRS exemptions.

Why is the tax service company counting you as resident alien then? Is there more information with respect to your status that you have shared with them but not here?

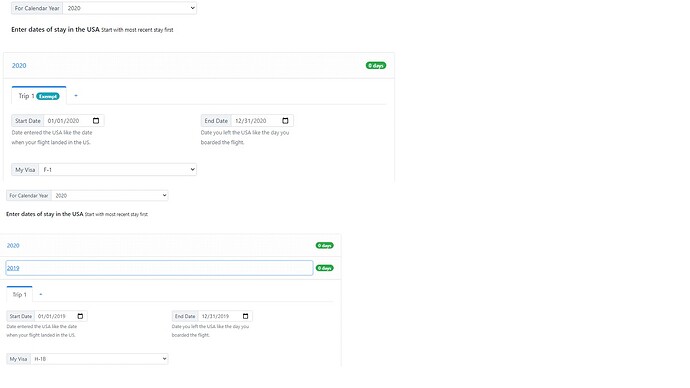

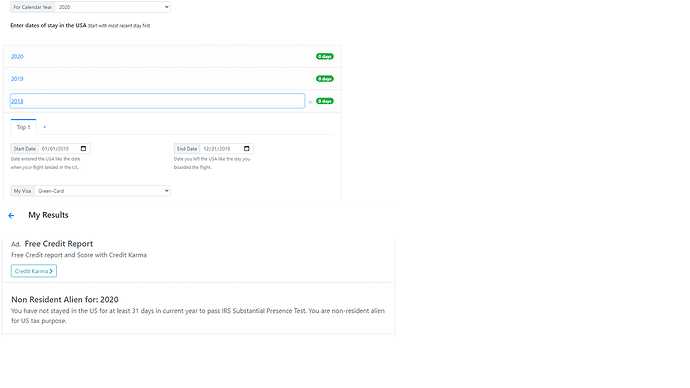

First year year 2020, the app says Exempt and for 2019 and 2018… I put H1-B/Green card although I was on TN. There is no TN visa type in the list to select. the result says Non resident alien.

Snippet of the result is attached. Please cross check. Thank you

You will be a Non Resident. As a student on F-1 visa, you qualify to be as an exempt individual https://www.irs.gov/individuals/international-taxpayers/exempt-individual-who-is-a-student