Originally published at: Will Social Security Benefits be Paid in India / Canada If I Leave USA? - Immigration

Most people in the USA working and contributing to Social Security taxes in the USA are worried about getting something back from the US government at their retirement.

The simple answer is YES, you are eligible to get your social security amount monthly after you turn 62 (retirement age) even if you are outside the US physically.

Eligibility

1 SSN credit is given for 1 quarter of social security tax contribution.

40 credits mean 10 years of contribution if you keep working and contributing without any break.

The 40 credits can be achieved in breaks also.

SSA.gov has a tool to test your eligibility for payments outside the US.

Example:

An H1B worker comes to work for Infosys in the USA. He pays social security tax for 6 years and then returns to India for offshore work. Infosys has an approved i140 for this employee.

He then changes his employer in India and joins TCS (Tata Consultancy Services).

TCS applies for his H1B transfer using Infosys’s approved i140 after 2 years in India and sends him again to the US for a long-term onshore assignment.

As soon as the person joins the TCS in the USA, the payroll starts again, and social security tax is automatically deducted before in-hand pay.

He has worked for another 5 years and continues to contribute to Social Security.

| Case 1 | Case 2 | |

|---|---|---|

| Total years of work | 11 years (6+5 years) | 9 Years 8 months |

| Total quarters of work | 44 (11 * 4 quarters per year) | 38 |

| Total SSN credits | 44 Credits | 38 |

| Eligible for SSN benefits | Yes | No |

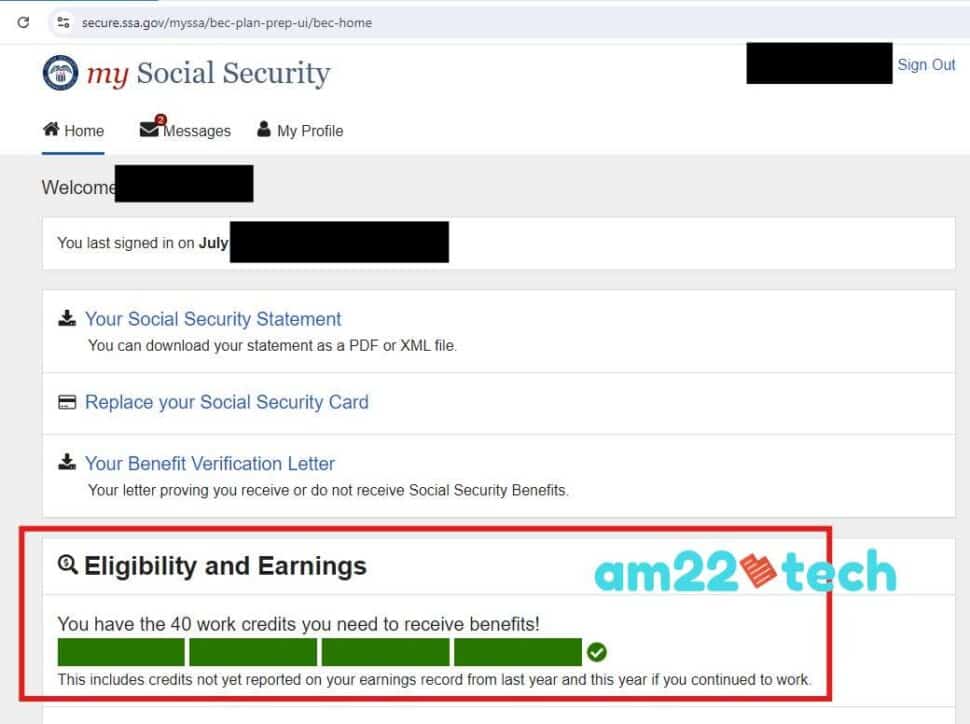

How to check my Credits?

You can register on the Social Security website for a free account and connect it with your SSN.

The website is pretty user-friendly and will show all your contributions irrespective of your work breaks.

You can even use your social account login like Facebook or Google to create an account on the SSA.gov website.

How to Apply for Social Security outside USA?

If you are living outside the USA and want to claim social security, you need to apply for it explicitly in the Social Security office located in your country.

If your country is not listed on the SSN website for an office location, then you should contact the US embassy in your country for the next steps.

Example:

If you are in India, you will need to visit the SSN office in Manila. You will need to visit the office 3 months before your retirement age i.e. 62 and apply for receiving benefits.

Once your application is approved and you are eligible (have 40 credits), you will start receiving your money in India.

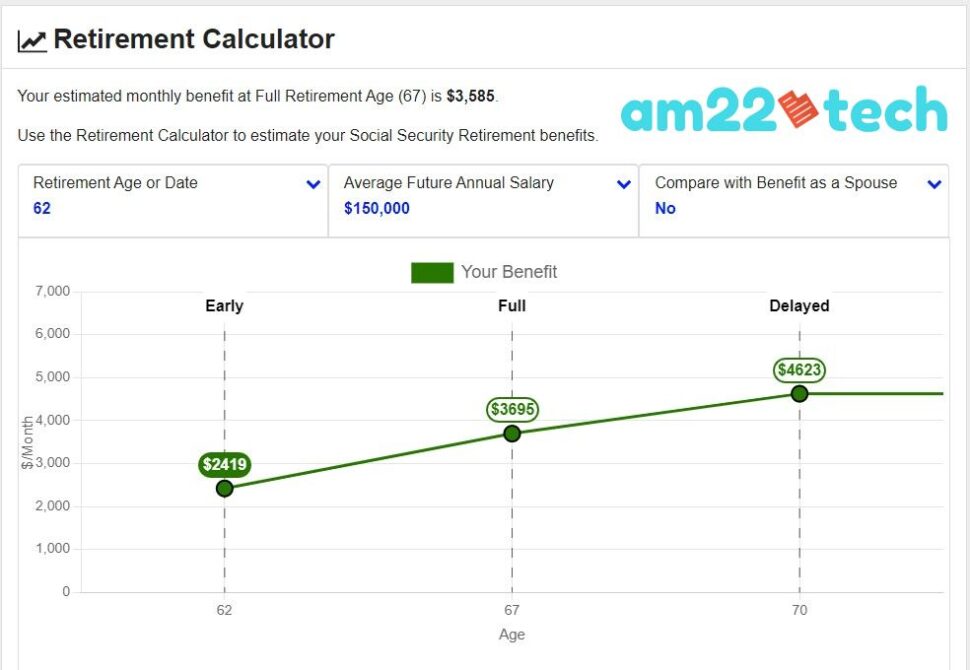

How Much Money Will I Get As Social Security?

The amount of social security is calculated based on several factors. You can check an estimate of how much money you are eligible for by entering your average salary in the calculator provided by the SSA.GOV website.

You will need to register on the SSA.GOV website to access this calculator.

H1B workers Eligible to Get Social Security?

I discussed this topic with one of my guests on my YouTube channel and they also have the understanding that one is eligible to get Social Security outside the USA:

FAQ

Yes, you are eligible to get Social Security benefits in India if you have a minimum of 40 credits as per the SSA.gov criteria.

Yes, you will be eligible to get social security money monthly when you retire at the age of 62 as per USA social security rules.

Yes, you will have to pay income tax in India or Canada or whichever country you are in based on that country’s income tax rules.

Yes, non-US citizens are eligible as long as they have contributed to social security tax for at least 40 quarters.

No. As long as you have contributed for 40 quarters and got 40 credits, you will stay eligible to get social security money after you reach retirement age.

No, you cannot add dependents as beneficiaries until you reach the retirement age.

No, there is no requirement to be in the US or visit the US.

If you are a US green card holder, then the green card maintenance conditions may require you to keep coming back to the US but they do not affect your Social Security eligibility.

There is no need to inform the Social Security Officer about your departure from the USA.

Everything is automatically connected and updated through your payroll deductions. If you ever return to the USA and your employer runs your payroll, the SSN deductions will be attributed to your account automatically.

No, you will not get any amount back if you have not contributed for at least 40 quarters.

Yes, you are eligible if you qualify with 40 credits.