oh . one of my frd received payement i140 + spouse EAD with itin… then his/her spouse might be having EAD …

@Anil.Gupta

Hi Anil,

I want to know about my case

h1b SSN + H4 ITIN + No kid and filed married jointly and total income was $110000

Am I eligible for it or not as per my knowledge they will calculate it as single and if income is more that 98k then you are not eligible

Please let me know if you have any idea about it

Hi @mca09528

Did your read this:

@Anil.Gupta, Yes I read it thanks for your response, but still I have doubt that will they consider the amount as $150 to give me $1200 or they will calculate from $75k?

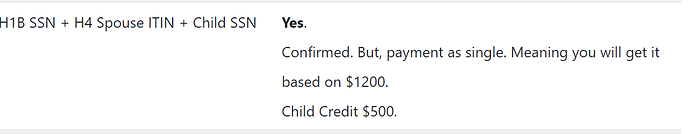

@honeycts, I think who is lying under below Condition, will not get money

H1 SSN + h4 ITIN

And filled married jointly and total

Income is more than 99k

Not true My friend falls under same category:

H1 SSN +H4 ITIN+Child SSN - He received 2400

Hi ,

I see a conflict here.

per your sheet this is for scenario for me (I am yet to receive)

but per your calculator if I put my details, I am expected to get $ 2900 for SSN(me)+ITIN(spouse)+ITIN(child 1)+SSN (child 2)

Am i missing something here ?

Cheers,

Have the same situation

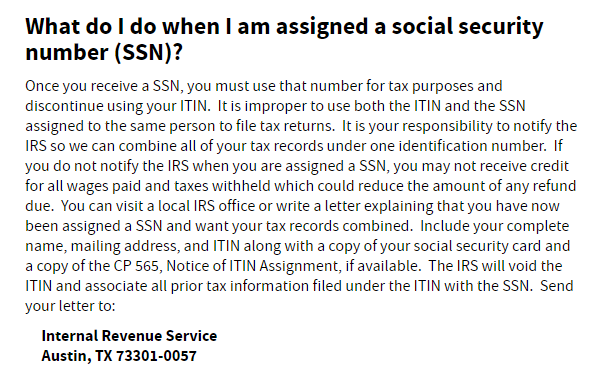

I am on H1 have filed TAX with ITIN for my wife she got ssn on last June 2019

Have 1 kid with SSN and another with ITIN

Will i be getting any thing or do i need to fallow any process?

Regards

Shahsi

Hi Kedar, can you double check with your friend whether 2018 taxes he filed single or joint ?

because all my friends and in his circle who fall under this category (H1 SSN +H4 ITIN) didn’t received.

Hi @honeycts

The calculator only calculates assuming that you have filed as ‘married filing jointly’ and both persons have SSN.

Calculator has been developed for all people and not only H1B non-immigrants.

Same scenario and I have not received. It will be good to know if others in the same scenario have got it.

He must be having h4 EAD for his spouse(SSN), please check with him.

Hi Kedar

When did ur friend recieve the deposit

what if my husband had an itin when we filled for 2018 taxes. he got a SSN in mid 2019 and we request the transfer from his ITIN to his SSN with the IRS. we haven’t filed 2019 taxes yet.

Would i qualify for stimulus check?

How many people received their checks already with H1 SSN with H4 ITIN wife MFJ status?

Its better to file 2019 taxes as early as possible.

Hey guys sorry i was wrong he did not receive the payment. On the same day he got 2400 salary credited so he got confused that with stimulus check.

Hello Anil, I got SSN for my wife last year Nov but still i filled taxes with ITIN. Can I file now amendment and get the stimulus check ?

I am no expert, but I was checking and came across this (screenshot from IRS website). As per the IRS website there is no need to file an amendment, we just have to write a letter. I am in the same boat and planning to write a letter to IRS to change from ITIN to SSN. However, I doubt if it will help with the stimulus check since I think the payment has already gone out to all eligible. I heard somewhere that they are going to send payments till the end of 2020, not sure if our cases will be considered.

Thanks for the information. Is CP 565 (Notice of ITIN assignment) mandatory?