It says if available, so must be optional.

I have letter format if you need it for reference. Please let me know your email address will send it to you.

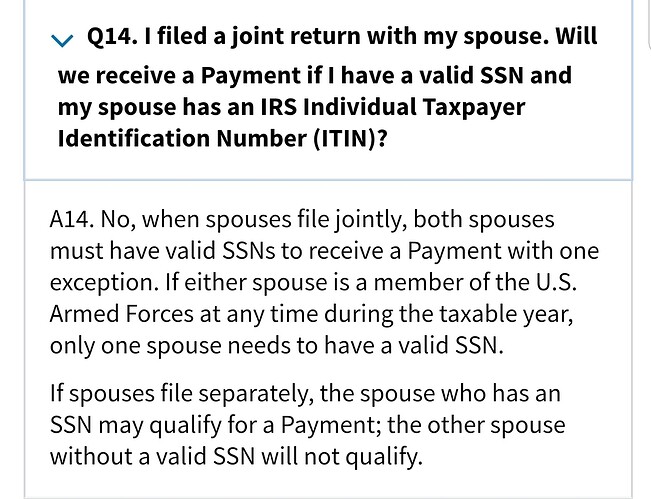

NO STIMULUS FOR H1B + H4 ITIN + CHILD SSN. This is per IRS website

Yeah seems like it. But did you see this on IRS website? Can you share the link or screenshot?

Not sure about what IRS is saying and why people are still receiving the payment.

People are reporting that they have received payment with H1B SSN + H4 ITIN.

Check this:

May be they qualified because income is less than 75K which is the limit for filing singl (for total benefit). After 99K singles are not eligible for stimulus payment. So anyone getting beyond 99K with ITIN spouse may not be eligible as they may be treated as single SSN.

good point. it is highly possible.

Also if any of you remember 2008, same thing happened, H1B +H4ITIN did not receive a penny. Even in 2008 it was around same time

i see your forum is only talking about visas holders. I am a US citizen though

For this combination , None of my friend or me received.

Asked my friends and they did not get it too. I think we will not get anything at this point. Not sure anymore to those who confirmed that they got it.

Correct those who filled with ITIN will not get anything. Not sure of someone has SSN and if he file for amendment he might receive it.

Ali i am in same situation any update on what to do next?

Nope not eligible for stimulus check

My case:Ssn + Ssn + itin(child)

Filed “married jointly” 2019 returns on April 01st

Irs deducted money owed on April 10th

April 24th :”Get my payment” started showing I am eligible and thereafter I put my bank details and taxes owed details as per 1040 doc

Now if I query by my Ssn or spouse ssn it show they have my bank details and once they have payment date ,they will do direct deposit

My situation is bit unique

SSN + ITIN (spouse) + ITIN (Child1) + SSN (Child2) : In 2018, married filed jointly

In 2019 My wife got SSN and we filed tax together with her SSN as below.

SSN + SSN (spouse) + ITIN (Child1) + SSN (Child2) : In 2019, married filed jointly

I didn’t receive stimulus. I am eligible ??

Hi @Siri1

You are eligible for Stimulus. IRS is processing checks in batches and you will get it soon if have not received yet.

Keep checking on IRS get my payment page.

Thanks Anil for response. I filed 2019 tax with direct deposit information. i thought all direct deposit cases are already processed, only manual check is left out.

My status still shows as “According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

A per below link, H1B SSN + H4 Spouse SSN + Child SSN + Child ITIN : is not eligible

You have not read the article correctly. It only says the child with ITIN is not eligible for ‘child credit’.

What about your 2018 returns?. Was 2018 returns also you did with Ssn + Ssn + itin(child) or was it itin for spouse …Ssn + itin+ itin(child)